This is Part II of a multi-part series on why we should get serious about launching a green bank in Georgia. If you missed Part I, you can find it here.

Part II – Green Banks

Green banks are specialized not-for-profit organizations dedicated to funding the growth of businesses leading the low-carbon transition. The name “green bank” is misleading as they operate much more like community development financial institutions (CDFI). Created in 1994 by the Riegle Act, CDFI’s are “private-sector, financial intermediaries with community development as their primary mission” and a focus on rebuilding “businesses, housing, voluntary organizations, and services central to revitalizing our nation’s poor and working-class neighborhoods.” CDFI themselves were building on the work of countless credit unions and community loan funds that preceded federal recognition. In many aspects, the Inflation Reduction Act of 2022 (IRA) is doing the same for green banks. However, with the IRA’s Greenhouse Gas Reduction Fund (GGRF), there is more than just federal recognition of the importance of community-based decarbonization; there is also $27 billion of direct funding.

Green banks are specialized not-for-profit organizations dedicated to funding the growth of businesses leading the low-carbon transition.

Like CDFI, green banks play a crucial role in the intermediation of capital at the community level. What makes them unique is the focus on reducing net greenhouse gas emissions (GHG). Green banks emerged at the state level in 2011 to combat the lethargic growth of clean energy and energy-efficient innovations. For these sectors, there has been a well-documented “Commercialization ‘Valley of Death’ – located somewhere between Silicon Valley VCs and Wall Street banks.” Without dedicated financing, adoption is slow as most clean-energy or energy-efficiency innovations have high-upfront costs while providing savings over time. Wind and solar generation are a great example. While both are highly competitive in terms of the cost per watt of electricity generated, the upfront investment in wind and solar PV farms make up “over 80% of lifecycle investment whereas those of coal and gas are about 65% and 32%, respectively”. Higher upfront costs increase interest rate sensitivity, making intervention more critical. Green banks intervene by reducing overall project costs or reducing the perceived risks.

Green banks start by aggregating and deploying public and private capital in coordination with private (often for-profit) investors and partners. In effect, they “leverage a limited amount of public or ratepayer funds” to attract much higher amounts of private capital by reducing the risk for “private investment to support energy efficiency and clean energy.” In addition, green banks accelerate consumer and commercial adoption of these (and other) low-carbon innovations through advocacy, awareness, and technical assistance.

In effect, they “leverage a limited amount of public or ratepayer funds” to attract much higher amounts of private capital

To create economic leverage, green banks use a variety of direct loan structures, provide credit support to existing lenders, and make equity investments, but they do not take deposits. Green banks are highly efficient at leveraging capital by investing in “projects that attract private capital and that also earn a positive return on the public funds that are invested.” Since 2011, U.S. green banks have catalyzed nearly $15 billion of investment, leveraging just $4.6 billion of subsidized capital. Roughly a third came in 2022 alone when 18 green banks across the U.S. catalyzed nearly $5 billion of investment on $1.5 billion of their capital. The demonstrated capacity for green banks to leverage their capital 3:1 or more is likely behind their sudden prominence.

It may come as a surprise that government-supported not-for-profit financial institutions can be highly capital efficient while supporting economic growth. But even before the Riegle Act, there was a long history of using public funds to efficiently catalyze market-rate investment. The Small Business Administration (SBA) was created in 1953 to accelerate small business formation and growth. On top of advising and advocating for small business owners, the SBA administers two loan guarantee programs credited with creating an additional 850,000 jobs between 1992-2007 alone, at $21,580 to $25,450 per job. More impressively, “estimates suggest that the job creation effects are sustained and even increase going out to five years after the loan.” The SBA’s loan guarantee program is not a direct lender and instead provides guarantees to existing lenders so they lend more at better rates. Despite the scale and impact, the SBA has a zero subsidy-rate goal for its loan guaranty programs, and “between 2014 to the present day, the program operated at zero subsidy”.

For a green bank to be equally effective, it should support industries that most efficiently reduce net GHG emissions in the region. That can be difficult to determine. Despite some common themes, each region has unique areas of opportunity based on industry or the existing energy mix. For example, data from the Energy Information Agency (EIA) shows that in Georgia, 47% of CO2e emissions come from the Transportation sector. In contrast, in West Virginia, Transportation makes up less than 15% of CO2e emissions. There can even be significant differences amongst neighboring states. Florida’s Residential sector is responsible for less than one percent (1%) of CO2e emissions, while in Georgia, it is six times that.

Moving beyond the broad industrial sectors, key innovations, and wider economic implications makes targeting specific solutions and businesses tedious and challenging. Despite the effort, several Southeastern states have recently undertaken studies and launched green banks. In 2022, South Carolina formally studied the potential for a statewide green bank. This year North Carolina announced the launch of the North Carolina Clean Energy Fund following a 2021 study. Neighboring Florida established the Solar Energy Loan Fund (SELF) in 2011.

Despite the effort, several Southeastern states have recently undertaken studies and launched green banks.

Georgia has yet to perform a formal study for establishing a green bank, though some conversations are happening amongst government and community development organizations. The opportunity for Georgia is significant, and the state has a clear advantage with existing technical research performed by leading academics.

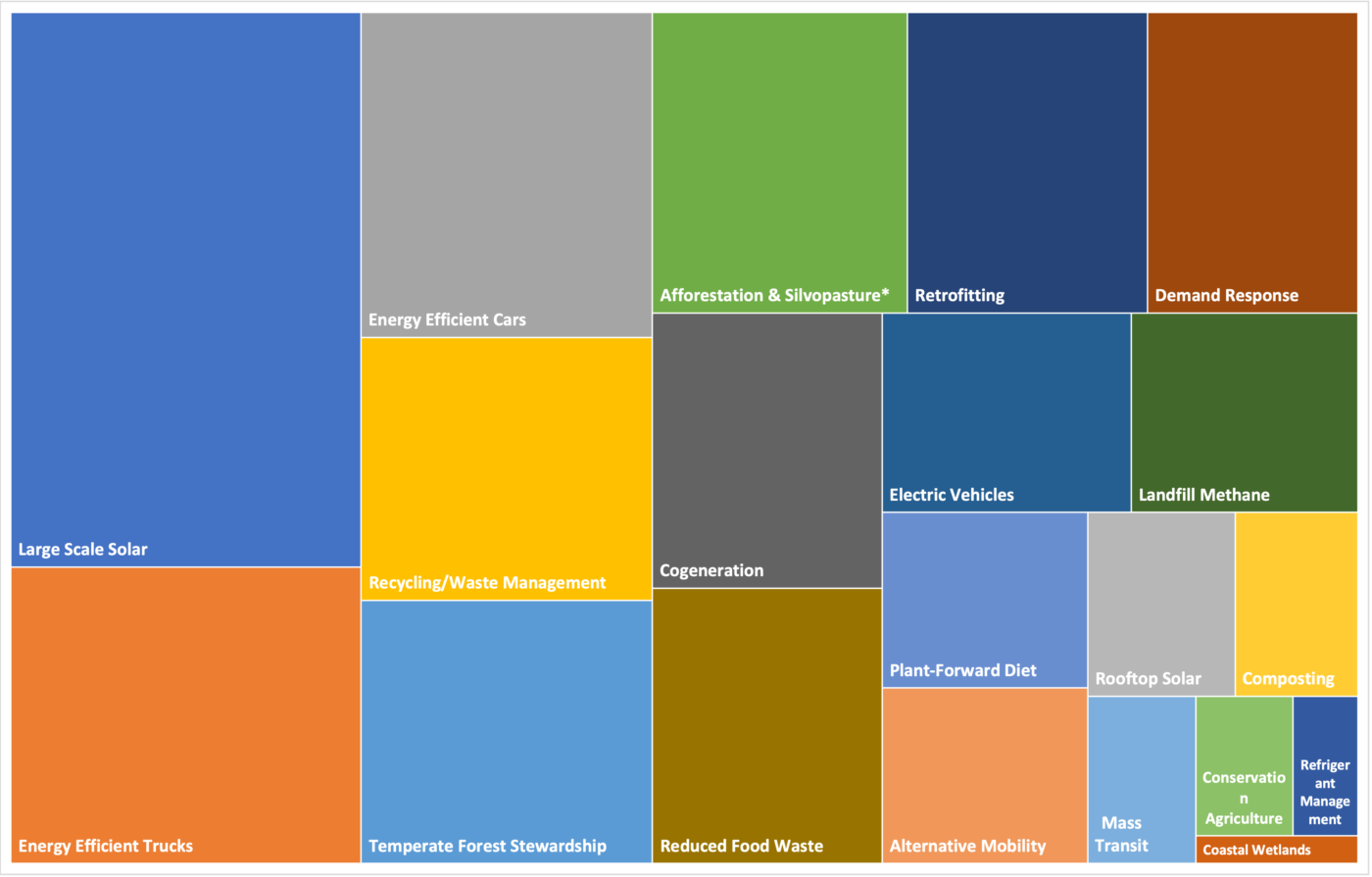

Drawdown Georgia (DDGA) was the first effort to take the global Project Drawdown research and localize it to an actionable political geography. The DDGA researchers narrowed down the geography and the scope of solutions, focusing on those most relevant to the state. The resulting 20 solutions can achieve a 50% or more net GHG reduction by 2030. More importantly, these 20 solutions are feasible technologically and commercially viable. The researchers note that the “achievable scenario estimates how emissions could fall if each solution was deployed at an ambitious but achievable level that considers costs, impacts, and stakeholder acceptance.” Whatsmore, the DDGA research has become an ongoing effort tracking GHG emissions by county and industry. A green bank in Georgia will benefit from DDGA research enormously, and empower it by catalyzing capital for the people and businesses underlying the 20 tailored solutions.