This is a multi-part series on why we should get serious about launching a green bank in Georgia. “Green banks” is a bit of a misnomer because they don’t offer retail banking like checking and savings accounts or traditional investment banking services. They operate more like community development financial institutions (CDFI), investing in small- to medium-sized businesses in under-served markets. For green banks, that under-served market is made up of the businesses leading our transition to a low-carbon economy. I’ll get more into how green banks work in Part II. For now, let’s focus on the urgency.

Part I – The $11 Trillion Opportunity

With the Inflation Reduction Act of 2022 (IRA), the U.S. set out to dramatically accelerate investment in decarbonizing our economy. Just a year in, there are signs it’s working. S&P reports that the first year tallied 83 investments in clean energy manufacturing facilities, including the $2.5B Hamwa Q-Cells expansion in Georgia. Research from Goldman Sachs suggests the IRA will provide $1.2 trillion in market incentives triggering $11 trillion of total infrastructure spending by 2050. A large share of that spending will happen before 2033, when the generous Investment Tax Credit (ITC) and Production Tax Credit (PTC) taper off. According to Goldman, investment of this scale has the potential to “make most clean tech — solar, wind, electric vehicles (EVs), and storage, as well as bioenergy, clean hydrogen, and carbon capture — profitable.” The key is scale.

Hamwa Q-Cells isn’t the only big IRA-related announcement in Georgia. An AJC analysis found “35 projects building everything from EVs to e-bikes and the batteries that power them” and pledges to create some 28,000 jobs. Another study from Energy Innovation suggests the state can add $4.8 billion annually to the GDP by 2030 and over 34,000 jobs across manufacturing, construction, and sales industries. That could be an under count. Energy.gov, an EPA website, says that battery supply chain-related investments alone already promise 23,000 new jobs and over $26 billion of investment for the state.

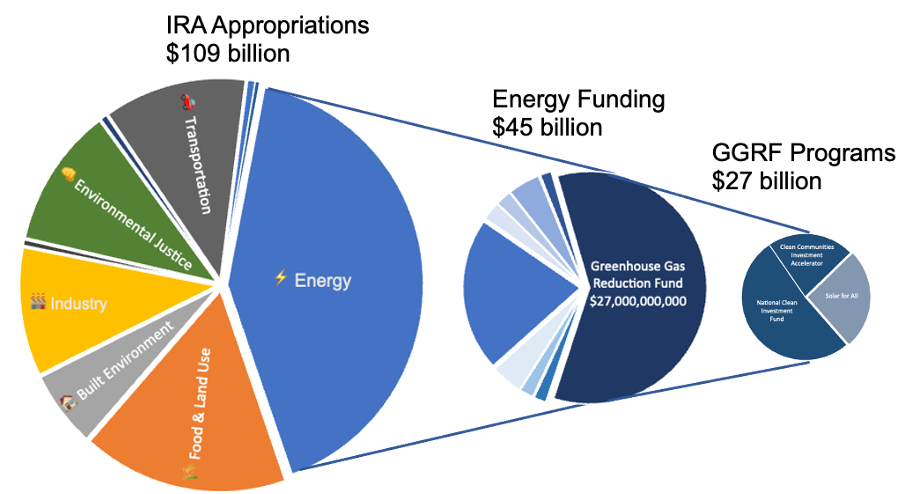

While most of the IRA’s incentives come from tax credits, the direct funding programs are just as important and slightly more predictable. Of the $109 billion in direct funding, the largest single appropriation is $27B for the Environmental Protection Agency (EPA) to create the Greenhouse Gas Reduction Fund (GGRF). The GGRF has a mandate to:

“mobilize financing and private capital to address the climate crisis, ensure our country’s economic competitiveness, and promote energy independence while delivering lower energy costs and economic revitalization to communities that have historically been left behind.”

https://www.epa.gov/greenhouse-gas-reduction-fund

Georgia has momentum on many of the opportunities the GGRF mandate outlines. The state is already responding to climate change and energy independence. Since 2017 the state’s carbon footprint has declined by 5% while GDP grew by 10%. That significant reduction in carbon intensity has come mainly from our electric grid. Georgia is ranked 7th nationwide with over 5 GW of installed solar, enough to power nearly 600 thousand homes. The state also benefits from significant growth in nuclear energy, but considering the cost overruns and delays, there is little chance we will see that grow beyond Plant Vogtle Units 3 & 4.

Progress is progress, but there is more that needs to be done. Last year alone, state utilities imported $3.7 billion of coal, gas, and oil. Those are essential dollars leaving the state while far too many of our residents need help to afford their energy bills. This is an opportune time for us to build on the existing momentum and respond to ongoing needs.

But we need to act fast. The EPA’s mandate requires them to get GGRF funds out by 2024. The urgency to deploy capital has led to some confusion, but what we do know is that there are three main programs designed to get the money out quickly:

- National Clean Investment Fund has $14B to expand the investment capabilities of 2 to 3 national-scale clean energy-focused nonprofit financial institutions.

- Clean Communities Investment Accelerator has $6B to fund up to 7 nonprofits committed to building the clean-energy funding capacity of community lenders in under-invested neighborhoods.

- Solar for All program with $7B for up to 60 grants for states, municipalities, and organizations supporting low-income residential solar projects.

The fact that Georgia has been able to scale GDP while reducing carbon intensity proves it can be done. The next step is to include the state’s 1.2 million small and medium businesses while ensuring the benefits reach those who most need them. That will prove more complex, and that complexity is, in part, the justification for a green bank. As the urgency of action meets the real needs of thousands of businesses and millions of residents, there needs to be a dedicated, nimble, and committed team that knows how to make and manage impactful investments.