Over the past few years, ID has worked to catalyze risk capital for underserved markets. To date, we have done this with direct investments from our BSP Fund, business co-creation through our BETA program, and deal syndication with fellow investors. Now, we are ready to announce our latest effort to support high-growth enterprises working in underserved markets.

The Impact Factoring Fund solves one of the most critical inhibitors to high-growth impact entrepreneurship. It levels the playing field for entrepreneurs starting in emerging markets where supportive infrastructure (taken for granted in Silicon Valley) is missing.

The Problem

Entrepreneurs working in emerging markets have a low-income consumer base that could benefit significantly from technology. Unfortunately, technology is often prohibitively expensive. Entrepreneurs in emerging markets are finding that their target market cannot afford to pay for technology, no matter how much benefit it offers in the end.

In the Western world, the solution is easy. There are a number of financing options available to consumers. Startups rarely have to provide any direct financing even when their product costs are high. In emerging markets, on the other hand, the dearth of bank savings, credit cards, and supplier credits forces technology companies to provide consumer-financing options themselves. Offering such credit options strains and limits the company’s growth. Customers in emerging markets have irregular income, no savings, and restrained cash; repayment on credit averages 24 months, even for small items. The lengthy payback period means that the company’s liquidity is tied up, which is detrimental in the high-growth phase.

High-growth businesses need to acquire customers quickly, but the lack of consumer finance means that upfront costs are high and they simply cannot raise enough equity to meet their demanding growth projections. The slow growth and long payback periods result in stagnated sales cycles, downward cash flow pressures, depressed balance sheets, and skeptical investors.

The Solution

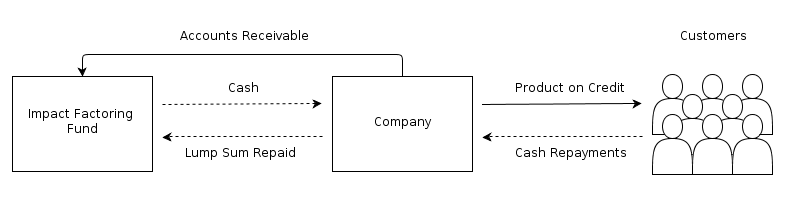

We have designed the Impact Factoring Fund (IFF) as a response to this problem. The IFF is an investment fund that leverages the fundamentals of “factoring” to provide short-term liquidity and working capital to early stage, high-growth companies in emerging markets. This will help companies who need to extend credit to their customers in order to scale.

Factoring is a financial transaction where accounts receivable (the value of payments owed to the company) are purchased at a discount in exchange for the future stream of payments (the aggregated customer payments). In other words, the IFF buys a startup’s accounts receivable to inject working capital while the customer pays back their credit at their own pace. The startup then pays the fund (IFF) back after it has received full payments from the customer. This way, the startups receive upfront cash infusion and develop a more continuous sales cycle, accelerating the growth of their business. Most valuably, this provides the startup with the ability to scale; it is no longer waiting for cash during long payback periods and more customers can afford and benefit from the startup’s products.

The first startups to participate in the IFF are in our BSP Fund portfolio, prime examples of high-growth, early stage companies. Implementing the IFF within our portfolio at first allows us to test the model with an assured level of transparency.

Benefits for Investors

The IFF makes companies more attractive to potential investors. Balance sheets are more attractive as the IFF turns liability into revenue immediately. Because it’s not debt, the IFF doesn’t distort debt to equity ratio of young companies needing to raise additional equity capital. Further, it reduces overall raise, reducing dilution while continuing high-growth trajectory. Investors have the opportunity to invest in a strong, high-growth company that has received the benefits of IFF, or can invest directly in the IFF to participate in early asset-based financing solution to working capital.

Invested Development’s Role

Invested Development is leveraging our unique insight into the market to design and manage solutions to high-growth impact startups. We have above-average levels of transparency due to our relationships with companies and deep insights into their markets. We serve as Fund Manager for IFF, ensuring sound investment policy that not only reduces investor risk, but also ensures the greatest possible impact for the enterprises and their target markets.

If you would like to get involved in the opportunity to fund high-growth ventures, please visit the IFF section of our website or contact us to learn more.

New here?

- Learn about what we do.

- Follow us on Twitter.

- Like us on Facebook.

- Join us on LinkedIn.

- Sign up for our mailing list.

- Got an alternative energy or mobile tech startup for emerging markets? Apply.

- Catch up on past Weekly Reviews.