Editor’s Note: Special thanks to our financial analyst and Excel whiz Lee Carter for his work on this post.

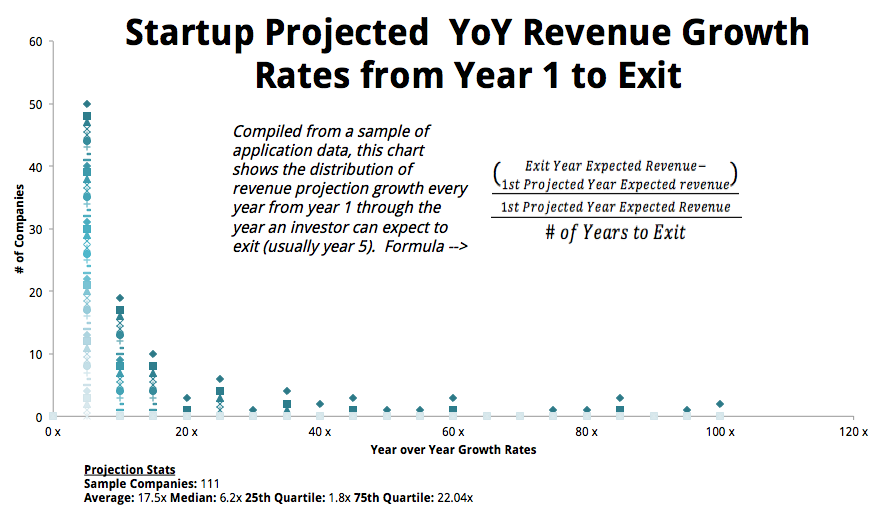

Startup projections come in all shapes and sizes. At Invested Development, we have seen 5-year expected revenues ranging from less than $300,000 to over $10 billion. One company might expect to make money selling to less than 10 customers for its entire lifetime, and another will expect to sell to over 250 million users by the time of an investor exit. Some companies expect to multiply their revenue by 100x every year for the next five years, while others expect a steady 5% increase in revenue over each year (see the chart below). Despite the differences, every startup can benefit from building its projections in a way that investors or anyone outside the company can easily understand and use.

Business plans and pitch decks provide the context in which your business works. Financial projections show how the business will succeed and what needs to happen in order to succeed. A simple yet thorough set of financial projections will not only get you in investors’ good graces, but also significantly decrease the length of the diligence process. This allows you to show off the exciting parts of your business for which you will likely raise thousands or millions of dollars. Below are some guidelines for you, the entrepreneur, to follow when creating or reviewing your company’s financial projections.

1) Assumptions should drive your projection and they should be easy to find.

Input assumptions (for both revenues and costs) should tell investors everything they need to know about what the company needs to do to become profitable. If these are clearly stated, investors won’t have to waste time trying to find exactly what makes your company run. You must be able to defend your input assumptions, preferably with outside validation. This can come from a bill of materials for cost of goods sold (COGS) and assumptions or comparable company statistics for user acquisition costs. Your final projection should NEVER have hard-coded numbers in it, if something is hard-coded, we will most likely be unable to understand why you made that assumption and it will be the first question asked about your financial statement. If you have to go back, try to remember what you meant, and then explain it to the investor, you are wasting valuable time and lowering investor confidence.

2) Revenue projections should be built from the ground up not from the top down.

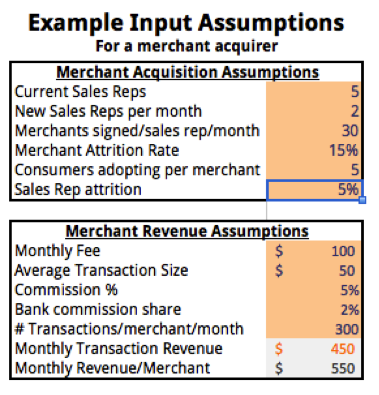

Revenue projections should be built on sales and marketing assumptions you create, which show how investment dollars will turn into revenue dollars. Some useful metrics to include depending on your type of business: user conversion rates, marketing spend, word-of-mouth speed/conversion rate, client onboarding process length, user attrition, returned goods, etc. If your revenue projections are based on a percentage of market share you expect to obtain, it only shows that you have not defined (or you are unsure of) your go-to-market strategy.

3) Financial projections are projections.

Projecting where a startup will be in five months, much less five years, is never an exact science. Investors understand that entrepreneurs cannot predict the future and that startups will pivot. Projections are not a strict budget, but rather a critical demonstration of the mechanics behind the business and goals for the future and an important roadmap. As long as you believe your assumptions are reasonable and achievable, and you can back that belief up with data, investors can use them as guidance to understand the business and analyze the potential scenarios and outcomes.

4) Less is more!

Building a model that includes all 48 countries you are expanding to in the next 10 years with 15 different products for each country does not help anyone understand how you are going to reach profitability. If your model can show how you will become profitable at a small scale, showing your ability to scale up should be done as simply as possible. Similarly, showing off your ability to use Vlookups, pivot tables, and offset functions in Excel only helps IF investors looking at your sheet can easily trace the projections’ calculations back to input assumptions. If we cannot easily trace the roots of your outputs, we might miss important pieces of the model that would help us understand why your company is so amazing.

5) Not all projected revenue is equally likely to occur.

Adding additional revenue streams to your company in future years is good to show you are thinking about other ways you can earn money. However, investors are more interested in how you are making money now and how that will scale up. Your assumptions for future data mining revenue or bulk unit shipments to distributors in Russia will be shakier than your projections for your first year sales to customers you have already identified. Investors want to see that you can become successful from the business lines that you have already started selling or have laid the groundwork to start in year 1.

6) Show some skin in the game.

In order to receive venture funding, investors need to know that you are in the game with them. You need to show that you are so passionate about your business that you are willing to invest your time and money with the expectation that you will be rewarded with future equity earnings (whether by exit or dividend). Asking for high starting salaries does not show you are confident in your abilities, but insecure about your future potential equity earnings. This is not to say that you shouldn’t be rewarded for your hard work. You should! All in due course.

7) Be wary of your cash flows versus your Profit and Loss statements (especially for hardware companies).

When evaluating an investment, investors need to know what their money will be used for and what money you will need to raise in the future. If all you can show is annual profitability of the company, we will have no clue how much money needs to be raised and when it needs to be raised. We created a whole segment of our fund to inject capital into portfolio companies who have cash flow constraints. Companies should show (at least) a two-year projected month-to-month cash flow statement with accompanying goals to achieve those numbers, and a five-year profit and loss statement, showing what investors can expect for the company around the time they hope to exit. Check out the Excel file called “ID Milestones and Timeline” on the Resources page for a template for the two-year projection (it’s easier than it sounds).

8) Justify your valuation (if you have quoted one).

If you have quoted a pre-money valuation for investment, the first question related to it will be “Why that amount?” If your answer is “a combination of sweat-equity, prior investment, and foregone salaries that we don’t have written down anywhere,” then the valuation is useless. Better ways are to:

- Show a valuation you have been offered by another investor;

- Calculate the net present value (NPV) of expected exit value;

- Point to recent valuations of (reasonably) comparable companies;

- Calculate your sweat-equity, cash in the business, asset value, and foregone salaries and show the sources and data to back it up.

These methods are quantitative and defensible. Investors will always do their own valuation calculations, but if you offer a well-defended valuation, it can show you have some reasoning for your quoted valuation and potentially sway investors to agree with you.

We hope that this post helps you navigate investor thinking during the diligence process. We’re committed to supporting entrepreneurs, and this advice goes for all startups, whether they identify as “social” or not. As impact investors, once we identify that your product or service solves a big problem and matches our investment thesis, it’s equally critical that we see that the business makes sense on paper. It’s the only way to ensure that your pay-as-you-go solar home system or farm management software can scale to have the biggest impact possible.

- Learn about what we do.

- Follow us on Twitter.

- Like us on Facebook.

- Join us on LinkedIn.

- Add us on Google+.

- Sign up for our mailing list.

- Catch up on past Weekly Reviews.

- Fundraising for a mobile tech, alternative energy, or ag tech startup? Apply.