In our recent post, Africa’s Big Three, we compared Nigeria – Africa’s third largest economy – to South Africa and Egypt – the first and second largest, respectively. We discovered that added mobile penetration could boost Nigeria’s GDP to outgrow Egypt’s by 2020. This prediction is a result of increased mobile penetration and its positive effects on economic growth. In this post, we’re following up on our prediction with a discussion of another benefit of mobile penetration – mobile money – and why Nigeria is more likely to enjoy it than Egypt.

Nigeria’s Advantage over Egypt

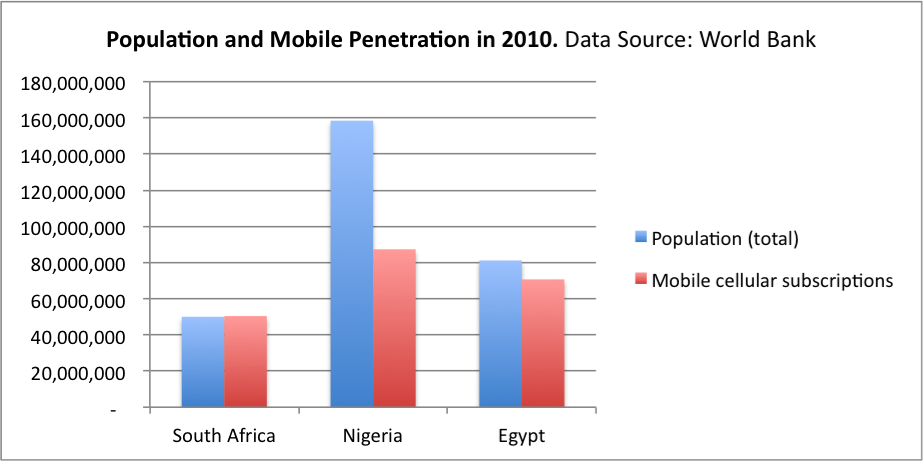

In our original analysis, we calculated baseline growth of GDP for Africa’s three largest economies using historical averages from the World Bank. Then, we added a multiplier based on the number of mobile phone subscribers that will be added until all three countries reach 100% penetration. In Nigeria, this represents a group of 80 million people out of a population of 160 million. In Egypt, this group is only 10 million people out of a population of 80 million. Eight times as many Nigerians stand to experience the benefits of first-time mobile phone ownership over the next eight years, which includes access to mobile money services.

Positive Effects of Mobile Money

While mobile money is still a relatively new phenomenon, a few studies have already linked mobile money directly to economic growth. For example, research on Safaricom’s M-PESA in Kenya at the University of Maryland found that mobile money creates local economic expansion in rural areas and can lead to improved agricultural production. By reducing the cost of remitting money to rural areas and enabling instantaneous transfers of money, business owners and farmers can access payments quickly and conveniently. For local economies, it leads to efficiencies that boost agricultural output.

Beyond the direct benefits of reduced transaction costs and increased availability of capital, mobile money also lays the groundwork for opportunities for innovation. It encourages entrepreneurs to innovate around the standard of transmitting money over a phone and build on it. For example, it enables entrepreneurs like Femi Akinde at Slimtrader to bring high value industries like e-commerce or m-commerce to emerging markets on a simple mobile phone. We see many other examples of this in the tech hub of Nairobi where M-PESA has opened a number of new paths for innovation. Mobile money has spurred the likes of Kopo Kopo and spaces devoted to mobile innovation like m:Lab. Lagos could be next.

There are also benefits for the individual. Access to mobile money improves cash flow, creating opportunities to spend money locally. Having a secure and convenient place to store money encourages individuals to save, rather than “store under the mattress.” People can pay for things without having to wait in line. For more examples of the impact of mobile money in Africa, check out Afrinnovator’s article “From Mobile Money to Mobile Finance: Effects of Mobile Money on Household, Community and National Economics.”

Given the obvious benefits of mobile money, governments should be actively promoting its adoption. There are many hurdles to overcome, such as regulation and interoperability, that require governmental oversight. Nigeria clearly sees mobile money as an opportunity for the country to grow, and is putting in great efforts to make it happen.

Comparative Promotion Efforts for Mobile Money

In the past year, The Central Bank of Nigeria has licensed 16 mobile money operators. Licenses are granted after the operator demonstrates a successful mobile money pilot. Already, operators have started to build their agent networks to foster ubiquitous mobile money usage. With government-mandated interoperability, the efforts of each operator should benefit the others – shortening the time for adoption to take off.

Further, the Nigerian government is making large efforts to decrease financial exclusion through mobile money. The goal is to reduce financial exclusion from 46% down to 20% by 2020 (Williams, 2012). To accomplish this, the government hopes to increase the number of bank branches and promote adoption through initiatives like “Cashless Lagos.” Cashless Lagos promotes the use of mobile money by placing a higher fee on large cash transactions.

Meanwhile in Egypt, protests and political turmoil have continued. Telco operators have taken a substantial hit to their revenue due to the economic and political instability. While several operators have received permission to begin offering mobile money services, Vodafone Egypt is waiting for the political environment to stabilize and security concerns to subside before committing the tremendous upfront capital to establish and brand an agent network. It seems likely that serious efforts to kick off countrywide mobile money services will be shelved for the foreseeable future, unless the political environment drastically stabilizes.

A Trend to Watch

With more than a dozen Nigerian mobile money services up and running and Egyptian mobile money services sitting on the sidelines, the odds that Nigeria quickly realizes mobile money ubiquity (and its economic benefits) are high. If that is the case, Nigeria may very well overtake Egypt as Africa’s second largest economy well before 2020, as we predicted based on mobile phone penetration alone.

To track this trend, watch the arrival mobile money providers on the scene, the collective efforts to promote the effort, and check out the vast network of informal economies that will benefit from mobile money.

Look out for our continued research on this topic – we’d love to hear what countries you’d like to read about next.

What other positive effects does mobile money have on the economy? Would you be interested in quantifying the multiplying effect mobile money has on GDP? Do you think that it will be higher in Nigeria than in Egypt?

New here?

- Follow us on Twitter.

- Like us on Facebook.

- Join us on LinkedIn.

- Sign up for our mailing list.