Over 70% of people in emerging markets do not have a formal bank account (Goss, Mas, Radcliffe, & Stark, 2011). Despite exclusion from what we consider formal banking, many people in emerging markets have figured out their own ways to save money. An increasing number of people are participating in informal savings groups.

Our goal in this series is to explore the effectiveness of savings groups. In this post, we’ll explain how they work and what the existing benefits are. Next week, we’ll explore their inefficiencies and ways the increasing availability of mobile money services can provide the opportunity to make them more effective.

What is an Informal Savings Group?

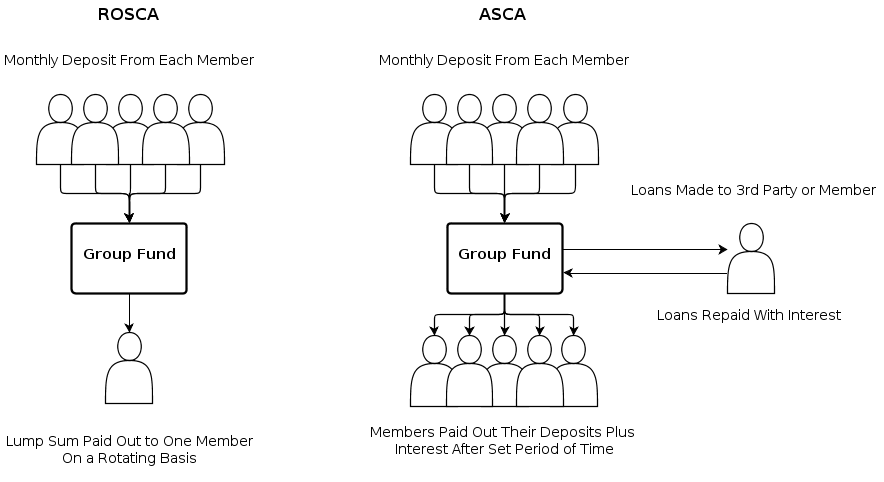

An informal savings group is a social organization formed to help community members save money for specific purposes (either individual or community level). The two most common examples are Rotating Savings and Credit Associations (ROSCAs) or Accumulated Savings and Credit Associations (ASCAs). ROSCAs function by taking monthly deposits from each member of a group and then giving the whole monthly sum to one member of the group. The recipient of the monthly sum is based on a predetermined rotation, ensuring each participant will eventually receive a large payout. ASCAs also require group members to make regular contributions. Instead of rotating payouts, the ASCA group fund is used to make loans that are paid back with interest. Loans are made either to group members or trusted third parties. After a certain period of time (often six months to a year) the group fund and its proceeds from interest are paid back to the original members.

Groups have different names and missions across countries. In South Africa, for example, you’ll find makgotlas for funeral expenses or stokvels for group purchasing or community entertainment. In Kenya, you’ll often find groups designed to save for a large investment that benefits the community, usually investing in a business or the Nairobi Stock Exchange.

Regardless of the name or purpose, most groups have a similar structure and protocol. Members are required to make a small monthly contribution to the community fund. Groups usually have 15-20 members and are governed by a strict set of rules, either written or unwritten, depending on the group’s literacy. Breaking the rules is considered “taboo” and comes with social repercussions and possible financial penalties.

According to FinMark Trust’s FinScope survey, there were roughly 37 million people participating in some kind of informal savings group in East Africa as of 2009. In West Africa, Nigeria alone had nearly 41 million people participating in such groups (Napier, 2009). The value these individuals gain from participation in a savings group includes both tangible economic benefits as well as intangible social benefits.

How Do Informal Savings Groups Provide Economic Benefits to Their Members?

Reducing Pressures on Free Cash

In emerging markets, an individual’s cash flows are highly uneven and cash on hand is subject to the pressures of family members and friends. Women in particular find that control over their money is limited, too often due to a frivolous or alcoholic husband. These circumstances make it nearly impossible to save a sum of money large enough to invest in a piece of equipment that would improve a business, purchase materials for home improvement, or make any other large purchase to increase quality of life. Savings allows members to shed the pressure placed on their free cash by husbands, neighbors, and friends. Ultimately, this enables people to commit their surplus cash towards future purchases with the potential to improve their quality of life.

Enabling Access to Funds for Unexpected Life Events or Large Purchases

Having access to a financial savings tool makes it possible to access to a pool of capital in case of emergencies or save money for a large purchase. In case of unforeseen illness, members can rely on their group members and the resulting group fund to quickly take out a loan. Ultimately, group members have to repay the loans or end up contributing the same amount over twelve months as if they had saved the money themselves, but participating in a group creates additional flexibility and builds a social structure that creates discipline. Such discipline also enables members to save up for large purchases, since the cash is safely put away for extended periods.

The Importance of Social Capital to Informal Savings Groups

Informal savings groups in South Africa provide fascinating insight on the importance of social capital to group members. South Africa has the most developed formal banking sector in sub-Saharan Africa, where 63% of the country has access to formal banking as of 2011 (Khumalo, 2011). Yet, surveys have shown that nearly 90% of members that save primarily through ISGs also have a formal savings account (Irving, 2005). These members choose to participate in an informal savings group because the social structure it provides creates benefit that cannot be realized by saving at a bank. There are three key benefits that the group’s social structure creates:

- Disciplined Saving: As mentioned briefly above, involvement in a group forces members to set savings goals and meet them each month. The negative repercussions (both economic and social) associated with failing to meet these goals create significant incentive to meet the monthly commitment. Maintaining this level of discipline is much more difficult as an individual, making group membership more appealing.

- Increasing the Strength of Social Networks: Working together towards the same financial goal as part of a group that meets each month creates strong bonds. It is common knowledge in the Western world that you are more likely to get a job if referenced to a potential employer by someone you both know. This principle works the same way in the developing world. Individuals are able to leverage other members of the group to further create opportunities for themselves.

- It’s Fun: It is important not to forget the human aspect of informal savings groups. Groups are formed with trusted friends or family and can often be a perfect excuse to get together once a month to socialize. Beyond just the economic opportunities, savings groups also offer a more enjoyable way to save money in comparison to simply visiting a stuffy bank branch to make a deposit.

Despite all of the benefits that a savings groups presents to its members and the community, there are certain problems or inefficiencies that can arise, which we outline in our next post. Check back next week to learn about the inefficiencies and how mobile technology can help.

Bibliography

“Dynamics of Kenya’s changing financial landscape.“ (June 2009). FinAccess National Survey 2009. FSD Kenya. Retrieved from http://www.fsdkenya.org/finaccess/documents/09-06-10_FinAccess_FA09_Report.pdf.

Goss, Salah, Ignacio Mas, Daniel Radcliffe, and Evelyn Stark. (May 2011). “The Next Challenge: Chanelling Savings Through Mobile Money Schemes.” The Mobile Financial Services Development Report. The Bill & Melinda Gates Foundation. Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1801743.

Irving. (2005). “Informal Savings Groups in South Africa: Investing in Social Capital.” (pp. 17) Centre for Social Science Research. The University of Cape Town. Retrieved from http://www.cssr.uct.ac.za/index.html

Khumalo, Jabulani. (2011). “Making financial markets work for the poor.” FinScope South Africa 2011. FinMark Trust. Retrieved from http://www.finscope.co.za/new/pages/default.aspx.

Malkamaki, Markku. (2009). “Informality and market development in Kenya’s financial sector.” (pp. 67-87). Financial Inclusion in Kenya. FSD Kenya. Retrieved 1 April 2012 from http://fsdkenya.org/publications/finaccess_analysis.php.

Napier, Mark. (29 January 2009). “FinScope SA: Restraints but no Frontiers.” FinMarkTrust. Retrieved from http://www.finscope.co.za/new/pages/default.aspx.

“Results of FinAccess National Survey.” (June 2009). FinAccess National Survey 2009. FSD Kenya. Retrieved from http://www.fsdkenya.org/finaccess/documents/09-06-10%20FinAccess%20FA09%20Brochure.pdf.

New here?

- Follow us on Twitter.

- Like us on Facebook.

- Join us on LinkedIn.

- Sign up for our mailing list.

- Got an alternative energy or mobile tech startup for emerging markets? Apply.

- Catch up on past Weekly Reviews.